This Week in Precious Metals: Making Sense of a Historic Week

If you have been watching gold and silver this week, you are not imagining things. This was one of the most volatile weeks the precious metals market has seen in years. Prices moved quickly, headlines followed, and it left many buyers wondering what just happened.

Earlier in the week, both gold and silver pushed to historic highs before pulling back sharply. Gold fell roughly 20 percent from its peak, while silver experienced a deeper decline before stabilizing. As of Friday, gold is trading near $5,000 per ounce, while silver has settled closer to the mid-$70 range.

Moves like this can feel unsettling, especially for newer buyers. But volatility after a strong run is not unusual in this market. Pullbacks are part of the process, not a sign that the reasons for owning precious metals have suddenly changed.

Why Prices Pulled Back So Quickly

Several factors came together to drive this week’s move, and most of them originated in paper markets rather than the physical bullion market.

First, the Chicago Mercantile Exchange raised margin requirements. Margin is the collateral futures traders must post to maintain leveraged positions. When margin requirements increase, some traders are forced to reduce or exit positions quickly. That kind of mechanical selling can push prices lower in a short period of time, even when underlying demand remains steady.

Second, uncertainty around Federal Reserve leadership added pressure. Markets were already adjusting to the nomination of Kevin Warsh as the next Fed chair, and questions around future monetary policy created hesitation among short-term traders.

Third, the U.S. dollar strengthened. Because gold and silver are priced in dollars, dollar strength often weighs on metals prices in the short term.

None of these factors reflect a breakdown in the long-term case for physical gold and silver. They reflect positioning, leverage, and short-term reactions in futures markets.

Paper Markets vs Physical Demand

This distinction matters more than most headlines will tell you. The futures market and the physical market do not always move in lockstep.

Much of the selling this week came from traders unwinding leveraged futures positions, not from long-term holders selling physical gold coins or physical silver bars. Physical demand tends to move more deliberately. Buyers of coins and bars are not reacting to intraday charts in the same way futures traders are.

That difference is why you often see sharp spot price moves without a corresponding collapse in physical premiums. Understanding how spot prices and premiums interact helps explain why physical demand can remain healthy even during volatile weeks. Our guide on spot price versus premium explains that relationship in more detail.

What the Midweek Rebound Tells Us

After the initial drop, both gold and silver rebounded meaningfully before prices became choppy again toward the end of the week. That pattern is common during periods of elevated volatility.

Sharp moves followed by partial recoveries usually signal that markets are processing uncertainty rather than establishing a new long-term direction. These swings do not tell you where prices will go next. They tell you that positioning is still being worked out.

How Long-Term Buyers Tend to Think About Weeks Like This

I am not going to predict where gold or silver will trade next week or next month. That is not how experienced buyers tend to approach this market.

What matters is that the long-term forces supporting precious metals remain in place. Inflation concerns have not disappeared. Central banks continue to accumulate gold. Silver faces ongoing supply constraints alongside industrial demand. Interest in assets outside the traditional financial system remains strong.

For buyers who have been waiting for a pullback, this is what one looks like. One thing worth paying attention to is that physical premiums on gold and silver have remained relatively stable even as spot prices moved dramatically. When paper markets are volatile but physical premiums hold steady, it often signals that real demand remains beneath the surface.

A Steady Approach in Volatile Markets

If you are newer to precious metals, weeks like this can test your confidence. That is normal. Buyers who tend to do well over time focus on why they own metals rather than reacting to short-term price swings.

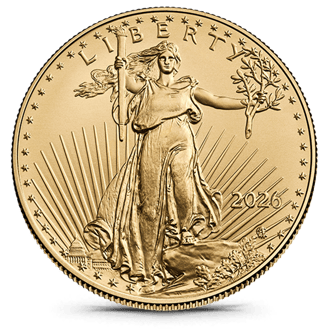

Building positions gradually, sticking with widely recognized products like American Gold Eagles and Silver Eagles, and tuning out daily noise are all part of a disciplined approach. Volatility does not eliminate the role gold and silver play in a diversified strategy.

Final Thoughts on the Week

My goal is to help you navigate these markets with clarity, whether you are buying, holding, or simply watching. Volatile weeks attract attention, but they do not change the fundamentals overnight.

We currently have fresh gold and silver deals available for those looking to add during this pullback. And if you have questions about what is happening or how to think about it, our team is always here to help.

.png?width=1170&height=172&name=2026_1_oz_AGB_-_Website_Banner_1%20(1).png)

.png?width=1200&height=675&name=Why%20Liquidity%20Matters%20(1).png)